Looking towards Winter 2017, Looking back on this time last year:

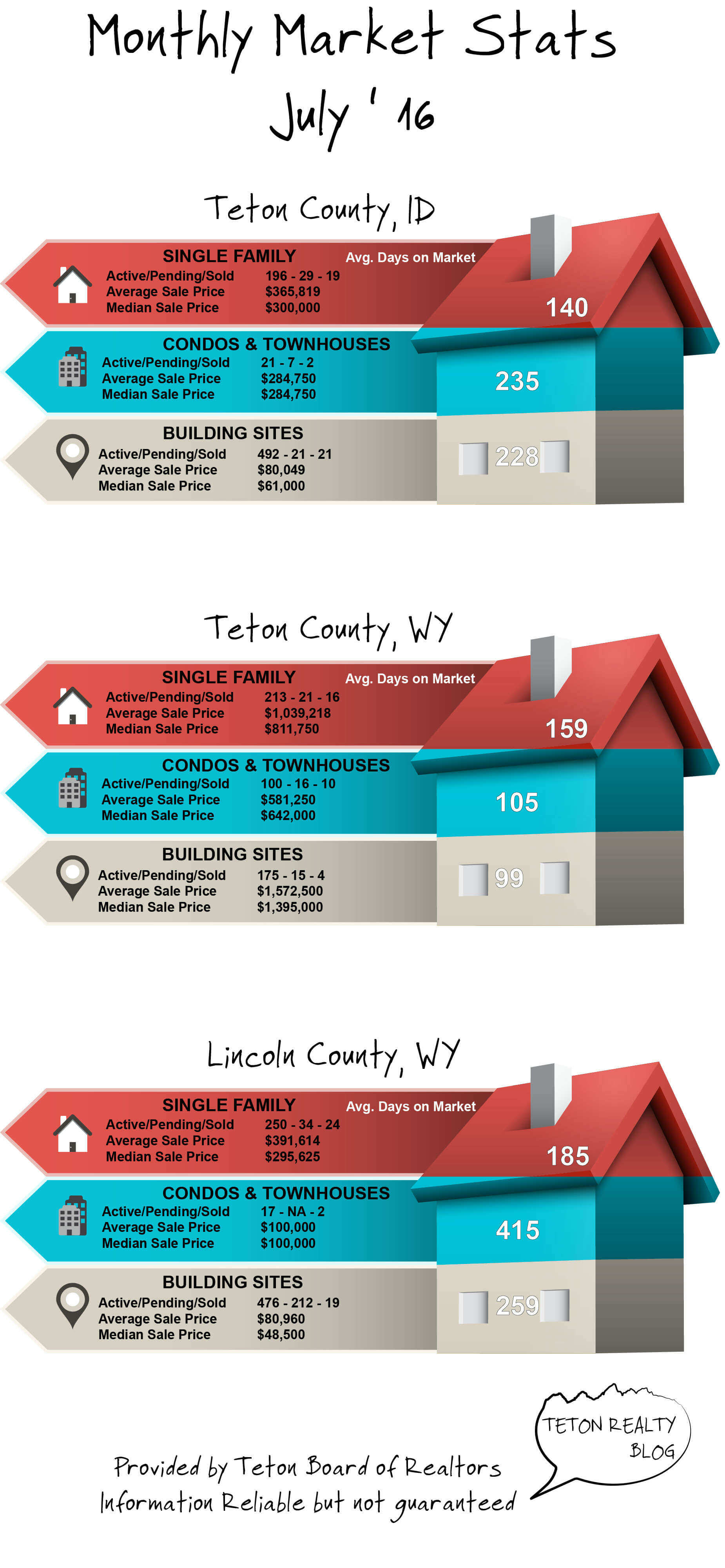

Teton Valley saw continued growth and increasing prices for residential and residential land throughout the spring and summer 2016 season. The 2016 season brought 107 sales with the average price coming in around $350,000 (including Alta, WY). While the 2015 Spring and Summer season brought 114 sales, the average sales price was about 9% lower with an average around $320,000. The increased average and the lower number of sales indicate lower supply, which we anticipate will continue through the upcoming Winter 2017 season.

With regards to land sales, the 2016 Summer season brought 102 sales with an average price of $88,000 whereas the 2015 season brought only 92 sales with an average price of $73,000, showing increasing prices at about 7% compared to last season, and a 10% increase in the number of sales. The supply is not limited such as with residential, though buyers and investors are looking to building to solve the housing supply and rental market crunch. Therefore we anticipate prices continue to rise, and the number of sales continue to grow each year, eating into current inventory.

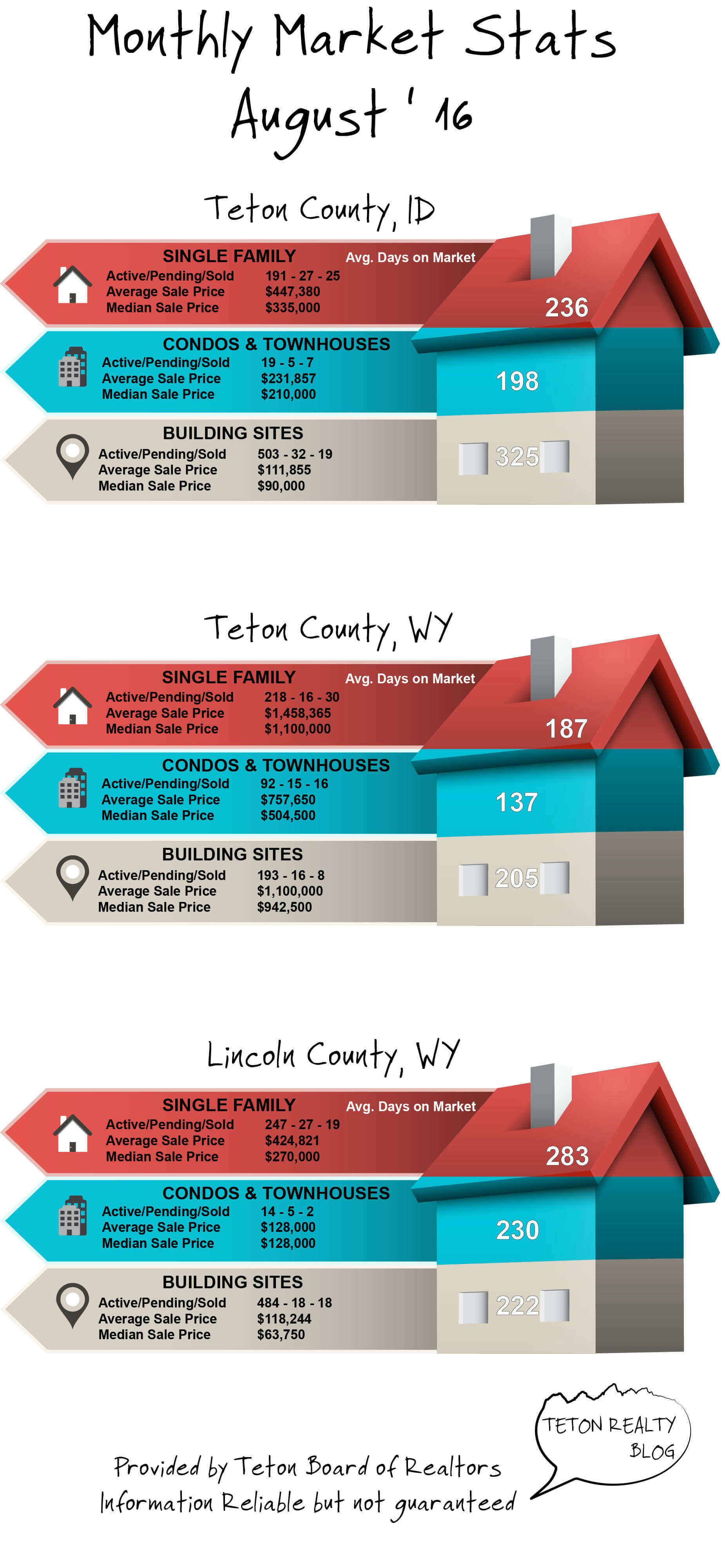

August 2016:

August 2016 reached new heights when compared to recent history. For the first time since 2007, the single family residential average sales price for the month was well over 400,000. Even the median price was in excess of 300,000, at 335,000.

The single family residential isn’t the only sector in the spotlight, building sites breached the 100,000 mark with an average sales price of 111,855, this is nearly twice the average sales price we saw in August of 2015.

Rental Market

Though the inventory is low and the real estate market is feeling the effects (both good and bad), nothing’s feeling the crunch quite like the rental market. The transition season has been all but nonexistent for the past several years, and the end of the 2016 Summer season is no exception. Vacancies are few and far between, and demand is as high as ever. With very little new construction for dedicated housing, we do not anticipate much relief for the transitional Workforce. As the residential Market continues to improve due to lack of inventory and home ownership costs increasing, this will only compound the issue for those residing in the area.