Usual disclaimer: I am not a lender. Always verify information and available programs with your lender. I recently wrote an article similar to this one, but I’m going to try to use this article just to get down to brass tacks on financing options and ways to get creative to get the best rate, and to lock that rate in the event you are purchasing new construction and are in a holding pattern.

Rate Locks & Extended Rate Locks

Many people don’t realize that you can lock rates for an extended period of time. This is an excellent tool when purchasing real estate that is under construction. Lenders usually carry products to lock rates for 6, 9 or even 12 months. While these products may come with a slightly higher rate, they often have options to “float down” the rate in the event rates begin to decrease. This is the best of both worlds.

Temporary Buy Downs

Temporary buy Downs can be a great way to secure a loan for someone that might be pushing their limits in terms of a debt to income ratio, and need to get their payment a little lower for the first couple of years. This buy down can sometimes be negotiated with the seller to be paid at closing, and provides the buyer with a payment that is a little more manageable for the first two or three years.

Permanent Buy Downs

Nothing new with buying your interest rate down up front, but it is important to look at the payback depending on how long you intend to hold the loan. Typically a buying “point” (1% of the purchase price amount) will get you a 1/8% to 1/4% lower rate, but it’s always great to get a quote because sometimes a point can get you an even greater discount.

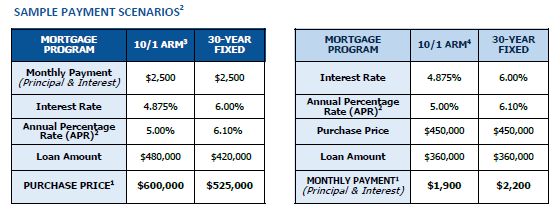

Adjustable Rate Mortgages An adjustable rate mortgage can be a scary thought, basically it’s fixed for a certain amount of time and can adjust up after the initial fixed rate period expires. However, below is an example of a comparison between a 10-1 adjustable rate mortgage and a 30-Yr fixed mortgage, roughly it today’s rates. Considering the average homeowner holds their mortgage or loan far less than 10 years, there’s quite a bit of protection as well as opportunity to refinance that loan during a decade long time span.