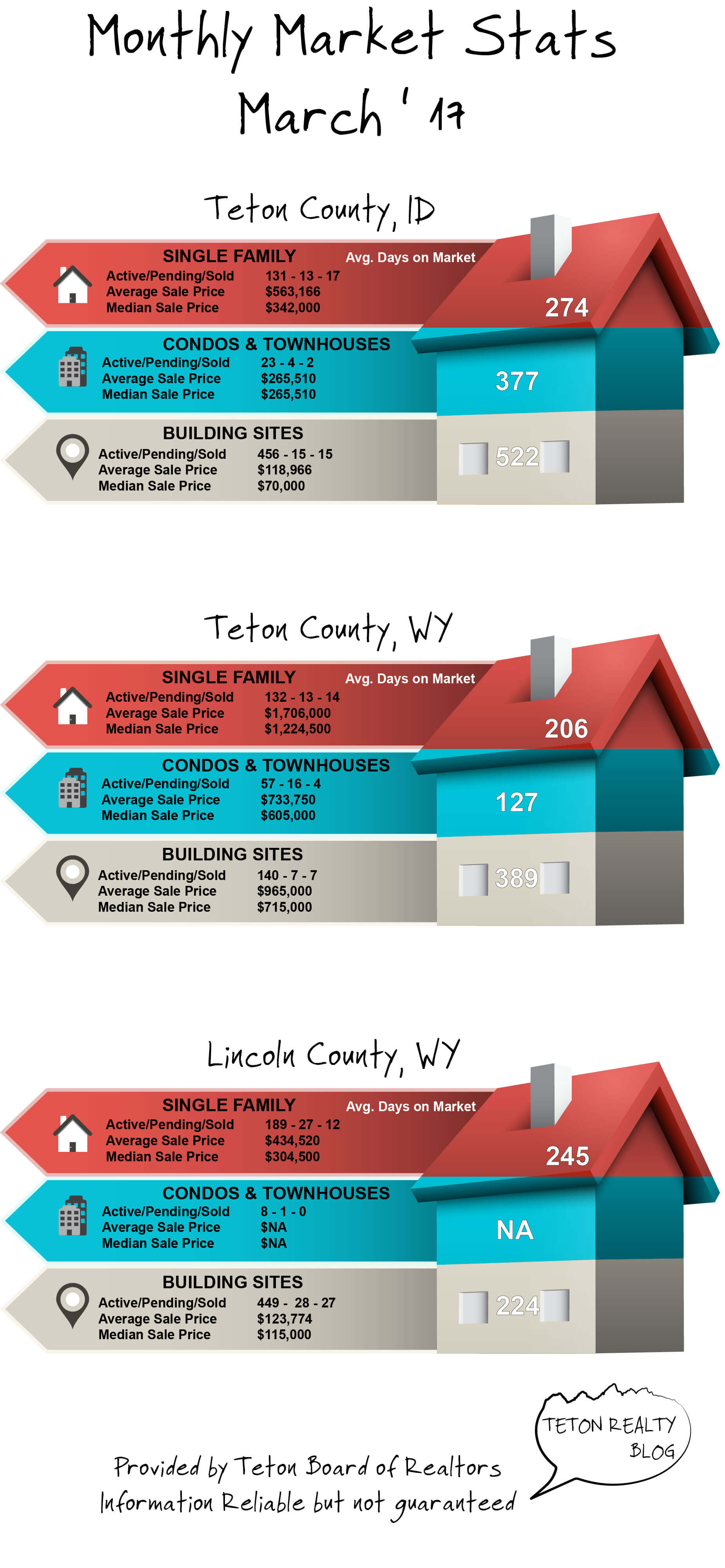

March ’17 Market Stats

Teton Region Real Estate Market Stats, Articles & News

8209 CUtthroat Lane, Victor ID 83455

3 bedroom 2 bath home located near downtown Victor in a popular development.

Why it’s a good deal:

Well, it’s under 300k for starters. Moreover, Brookside Hollow is a quality development with homes sales far exceeding 300k.

How much?

$299,000.

How quick will it sell?

Pretty darn quick. This is a hot area, a hot segment and a reasonable price.

MLS info below. Log in to save this property.

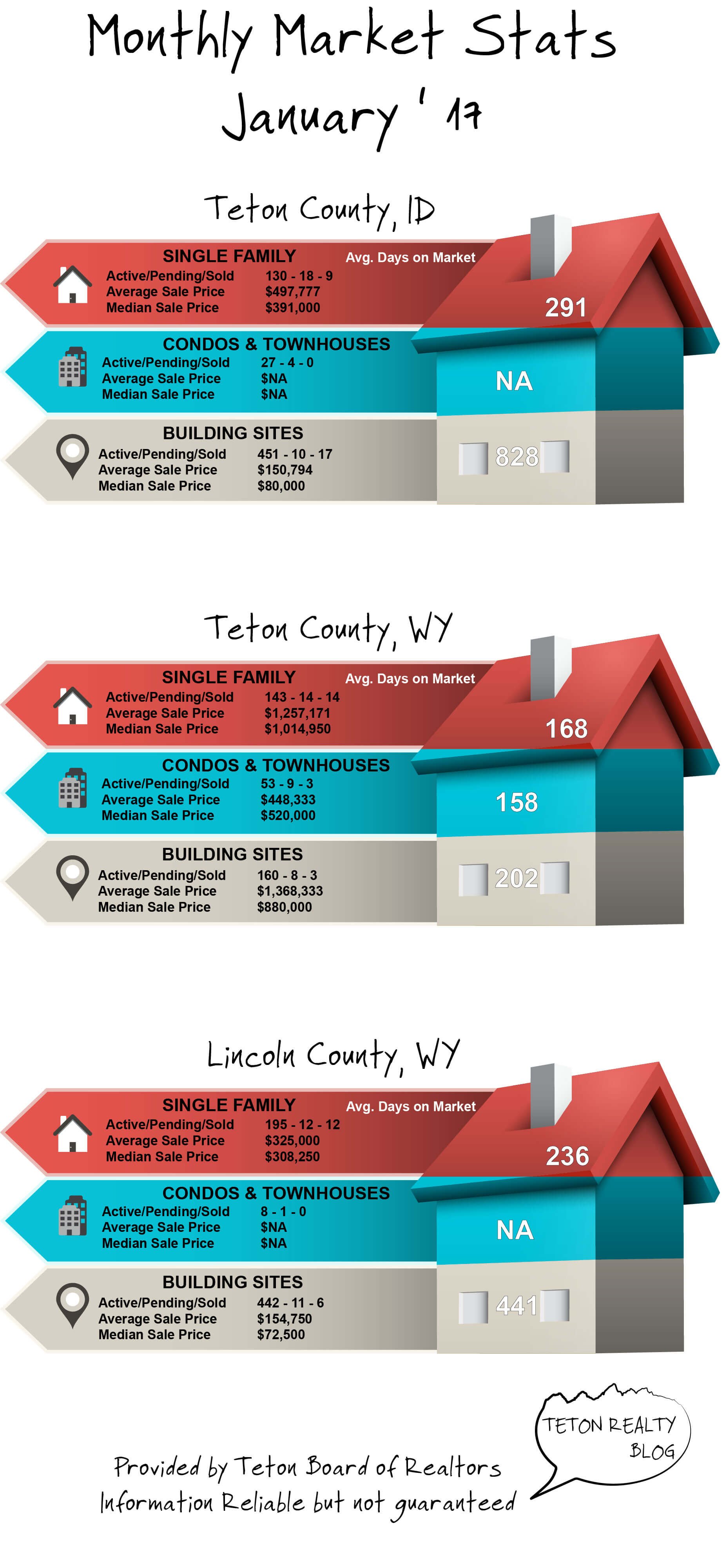

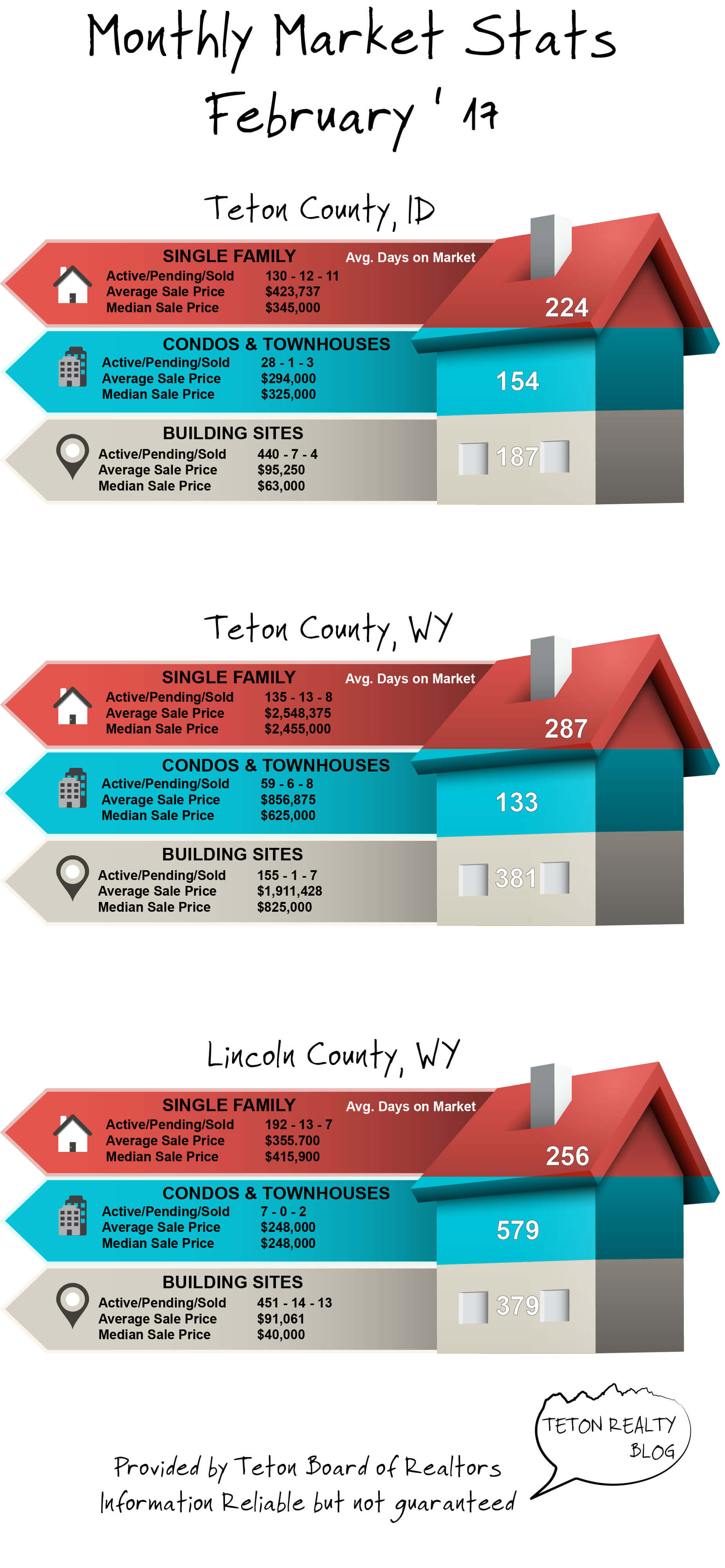

2017 is starting off a bit slow in terms of sales, but prices remain very strong. As the holidays become smaller in the rear view mirror and Spring Break approaches we will anticipate a strengthening market and more residential sales, especially as new home construction begins to break ground across the Valley, likely as the snow begins to melt in late March. For the 9 residential sales in Teton Valley, the average sales price was $497,777, one of the highest numbers we have seen in a decade.