On September 18th, 2024, I attended an open house for a special board with Teton County in conjunction with a FEMA representative for the updated project timeline for new (long-awaited) floodplain maps. Obviously, the information below is my interpretation of that presentation, so always verify information with State, Local and Federal officials.

The purpose of the open house was to review the preliminary floodplain map data released on August 15th. This data was last updated in 1988 with the limited technology at the time. An attempt was made in 2011 to update the mapping with a LIDAR flyover of the county in 2011. However, Teton County GIS coordinator Rob Marin (thanks, Rob) pointed out some deficiencies based on the year and time of year that may have inadvertently resulted in inaccurate and exaggerated flood data. This led to another recent flyover with a greater level of accuracy based on the timing, and newer technology. This new data will lead the way for a 90-day appeal process for those that can provide strong evidence that the new map data is inaccurate. For any objections, it should be noted that a letter of final determination is expected in the Fall of 2025, with final maps taking effect early 2026. The 90 day appeal process is expected to begin in February of 2025 and end in May of 2025. Comments can be provided, and forms are available on site at the Teton County courthouse and online for these appeal processes. This could be something as simple as an incorrect street name, or a more significant appeal such as a formal objection with evidence of inaccuracies. An appeal requires quite a bit of work, and as such, will require some form of significant evidence as to the inaccuracy, usually involving engineering (data based) reports. However, these scenarios will be investigated. These should be provided to Teton County who will pass the comments along to FEMA.

With that out of the way, the meeting was informative as to the new data, how it is mapped, and how it can be beneficial to Teton County. In attendance at the meeting was a representative for FEMA’s Region 10, Marshall Rivers. FEMA’s primary concern is safety, predicting flood risk and preparing for flood events. The last time the flood maps were updated was 1988, and with vast, new technology, FEMA was able to map not only flood information, but ranges of flood risk (as well as a side benefit of 2 foot contour elevations now available from the county). This program for updating the data was in collaboration with local government and the National Flood Insurance Programs (NFIP) in conjunction with FEMA. The federal government is responsible for mapping communities on a continuing basis. The state governments prioritize areas for future mapping studies, and local governments provide local insight and support. They also integrate the data into planning mechanisms and processes.

How are the maps made?

The maps are made using ground survey and LIDAR technology to identify areas of floodplain. The floodplain is generally an area that can be affected by flood or high water. LIDAR is a laser-based aerial tool with extraordinary accuracy that can sense surprisingly small objects. As mentioned above, a byproduct includes two foot contour elevations across almost the entire county. This data can be used by surveyors or land owners for planning and building purposes. There are limitations to these maps which include some uncertainties or uncontrollable circumstances such as log jambs, changing rivers or even land impacted by wildfires. In addition to LIDAR, hydrology and measuring the flow of water is a big consideration in establishing these maps. FEMA worked with Teton County to add study zones with some tasks led by FEMA, and others led by Teton County and other agencies.

Updated Zones and Associated Risks

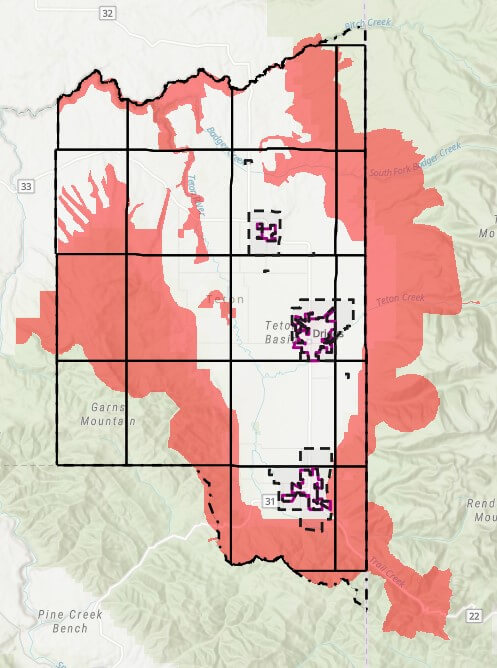

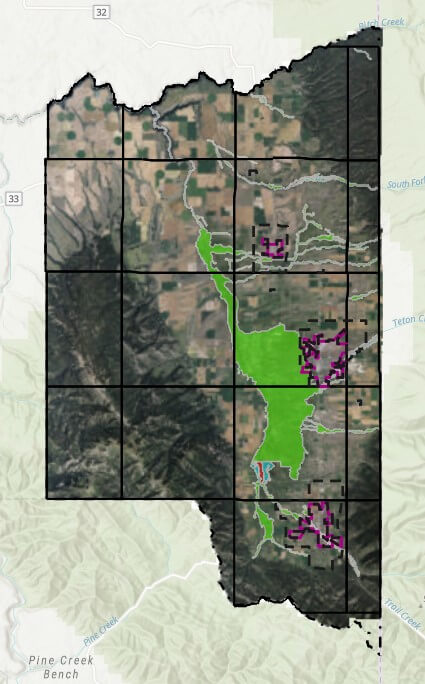

This new data offers a more granular prediction as to certain areas and their risk levels. Two types of flood hazards were mapped. The moderate flood risk (Yellow, when viewing the map) is intended to show a 0.2% annual chance of flooding (or less impactful areas), and high flood risk which is estimated to be a 1% annual chance of flooding (or more impactful areas). In addition, Floodway (as indicated in these maps in red), indicate areas that could be most impactful, and should be avoided. I was unable to determine the county’s future role in special requirements or restrictions in these areas.

Insurance

Just because a home is not in one of these identified rest areas, does not mean that there is no risk of flood. Conversely, if your home is removed from these flood areas with the new mapping, it doesn’t necessarily mean that you should cancel your existing flood insurance. According to FEMA, one out of four people who have a claim are not in an area mapped and identified as a high-risk flood area. If your property is added into flood zones in these amended maps, you may be contacted by your lender (and should consider risk insurance, regardless). My understanding is that your flood risk is evaluated by your lender and insurance provider. If homes are built above the base flood elevation of the risk area, this can minimize the added cost, or potentially even the requirement for insurance. You can learn more (and confirm my beliefs) at floodsmart.gov.

Base Flood Elevation & Development This new data will provide some instant data for what used to require elevation certificates to prove the base flood elevations. Information that may have once required an engineer to evaluate may now be immediately available with the new data. You do need a floodplain development permit whether you are handling infrastructure or building a home, but FEMA does not restrict development in floodplain areas.

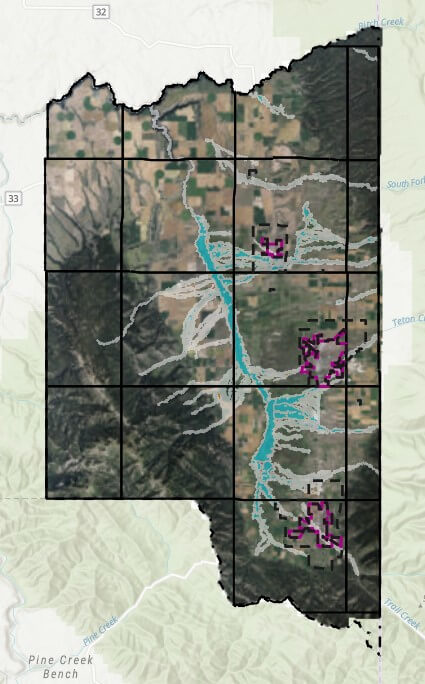

OLD DATA (circa 1988)

NEW DATA (as of August 15th, 2024)