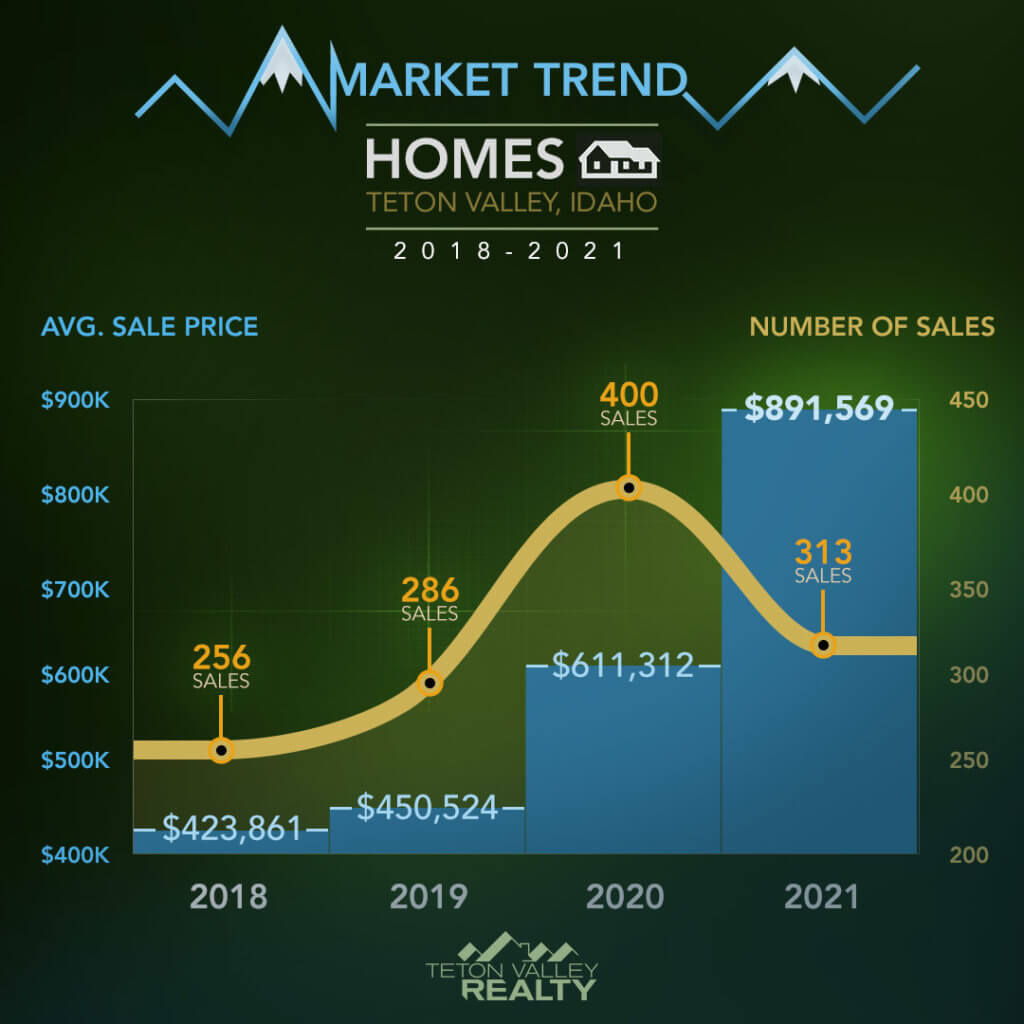

Unless you were living under a rock for the past 2 years (which might have been nice) you probably know that property values are up significantly. Until now, we haven’t seen County assessed values follow suit. With the recent release of 2022 assessed values, many are concerned that property tax increases are soon to follow. However, this doesn’t necessarily mean that your tax bill is going to go up proportionately.

In Idaho, each county is allowed to increase its property tax budget by up to 3% of the highest property tax budget of the past 3 years. The county can also increase their budget to account for new growth.

In order to calculate the tax rate, each taxing district within the county (Teton County has 18 taxing districts that each have slightly different budgets and needs) determines a levy, or the rate of which the county will multiply the assessed value to determine each property’s annual tax bill.

As an example, let’s say that district 1 has a total budget of $900k. In 2021, the total market value of every property in district 1 is $70m. To determine the levy, we would simply divide 900k by 70m, or 1.287%. If your assessed value is $300k, we simply multiply that by 1.287% to arrive at your 2021 tax amount of $3,861.

Now, let’s run a hypothetical based on what we are seeing today. We know that the total budget is going to increase with the new growth and the state’s allowance to increase the budget by up to 3% (ahem, inflation). Let’s assume that the new budget is $990k, and the collective value of all properties has risen to a whopping $110m. Using the same math, we divide $990k by $110m and arrive at 0.9%. Your value went from $300k to $450 this year. The math puts your 2022 tax bill at $4,050. While your tax bill has risen, it hasn’t risen 150% like your assessed value has.

The good news? Property values are up, and I know an agent that would love to sell your house.

Key Dates:

- Mid-November – Current year tax bills mailed

- December 20th – FIRST HALF TAX PAYMENT DUE

- March 15th – Agricultural Exemption Applications Due

- April 15th – Application deadline for Hardship Tax Relief or Circuit Breaker Program

- April 15th – Application deadline for Homeowner’s Exemption

- June 20th – SECOND HALF TAX PAYMENT DUE

- First Monday in June – Assessment notices sent out

- Last Monday in June – Last day to appeal current year’s property values

- Summer – County begins planning budget for following year

- Second Monday in September – County certifies budget