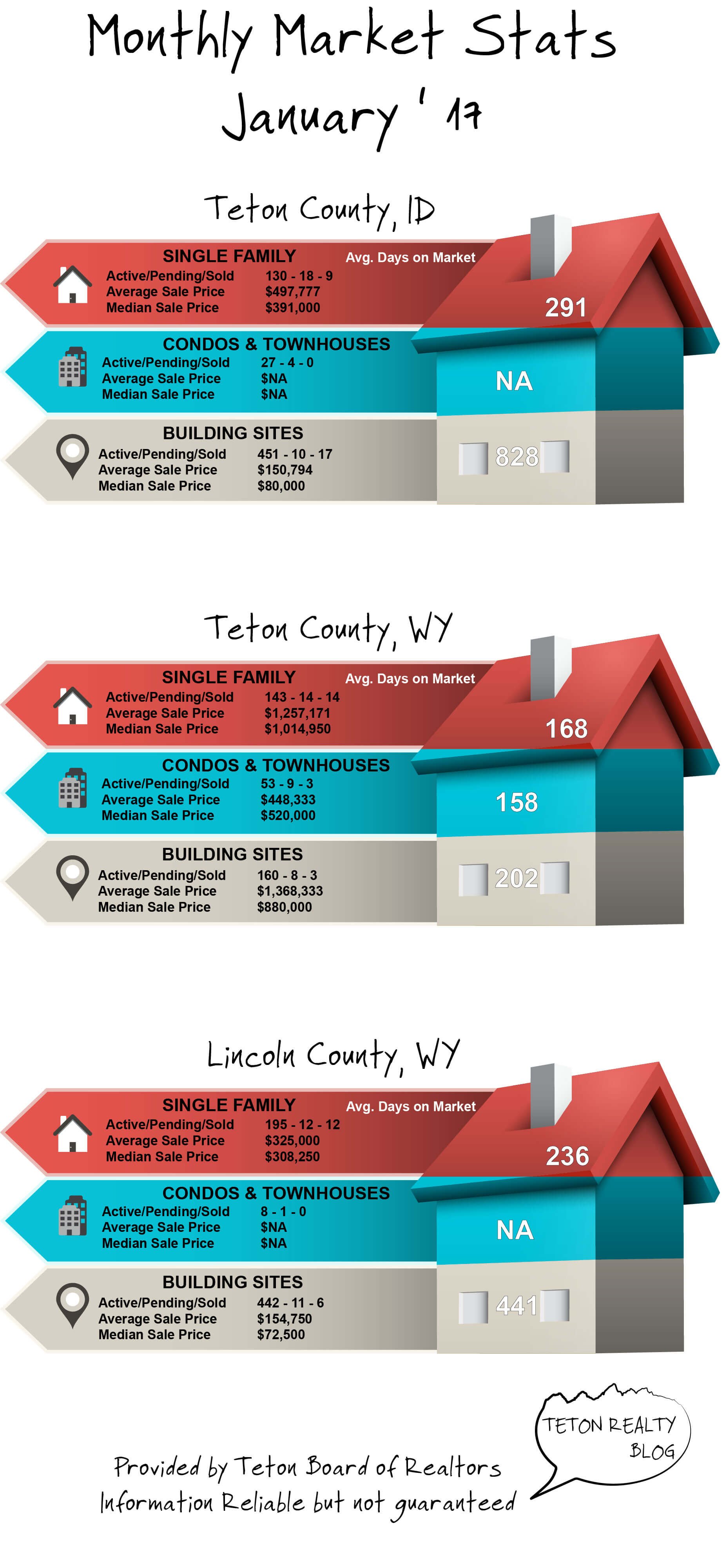

2017 is starting off a bit slow in terms of sales, but prices remain very strong. As the holidays become smaller in the rear view mirror and Spring Break approaches we will anticipate a strengthening market and more residential sales, especially as new home construction begins to break ground across the Valley, likely as the snow begins to melt in late March. For the 9 residential sales in Teton Valley, the average sales price was $497,777, one of the highest numbers we have seen in a decade.

Last week I promised an article on the potential for a localized market bubble. Refer to last weeks article;

Last week I promised an article on the potential for a localized market bubble. Refer to last weeks article;