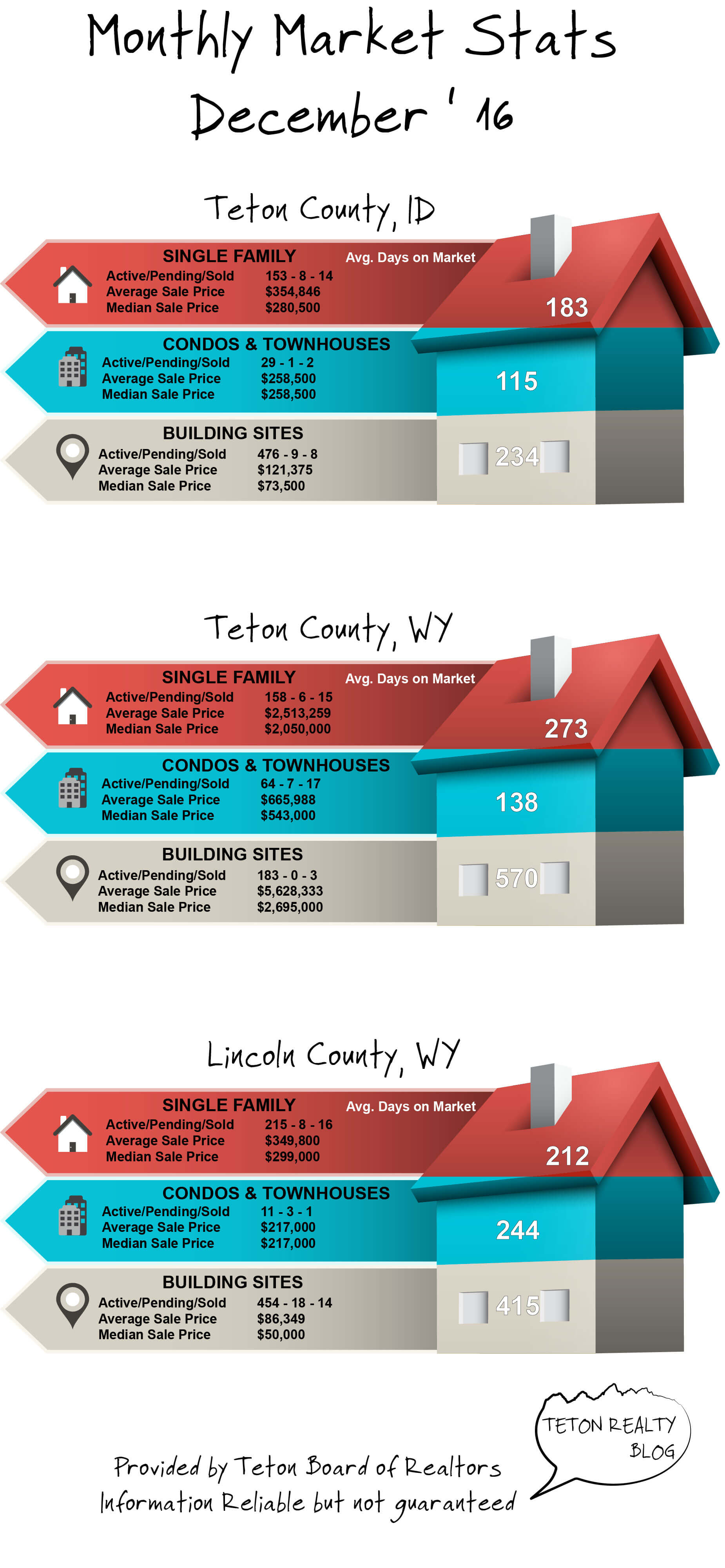

Teton Valley including Alta saw nearly 200 residential single-family sales in 2016, an improvement from 2015, even though inventory remains low. Condo and townhouse sales were on par with the year prior, though prices have increased in various sectors in the Valley. The number of building site sales in the Valley increased by 10% in 2016, and the average sale price ended at over $120,000 for the month of December 2016.

In anticipation of new construction in the coming year, I thought I would run through a couple of frequently asked questions and provide a bit of advice for new home shoppers.

In anticipation of new construction in the coming year, I thought I would run through a couple of frequently asked questions and provide a bit of advice for new home shoppers.