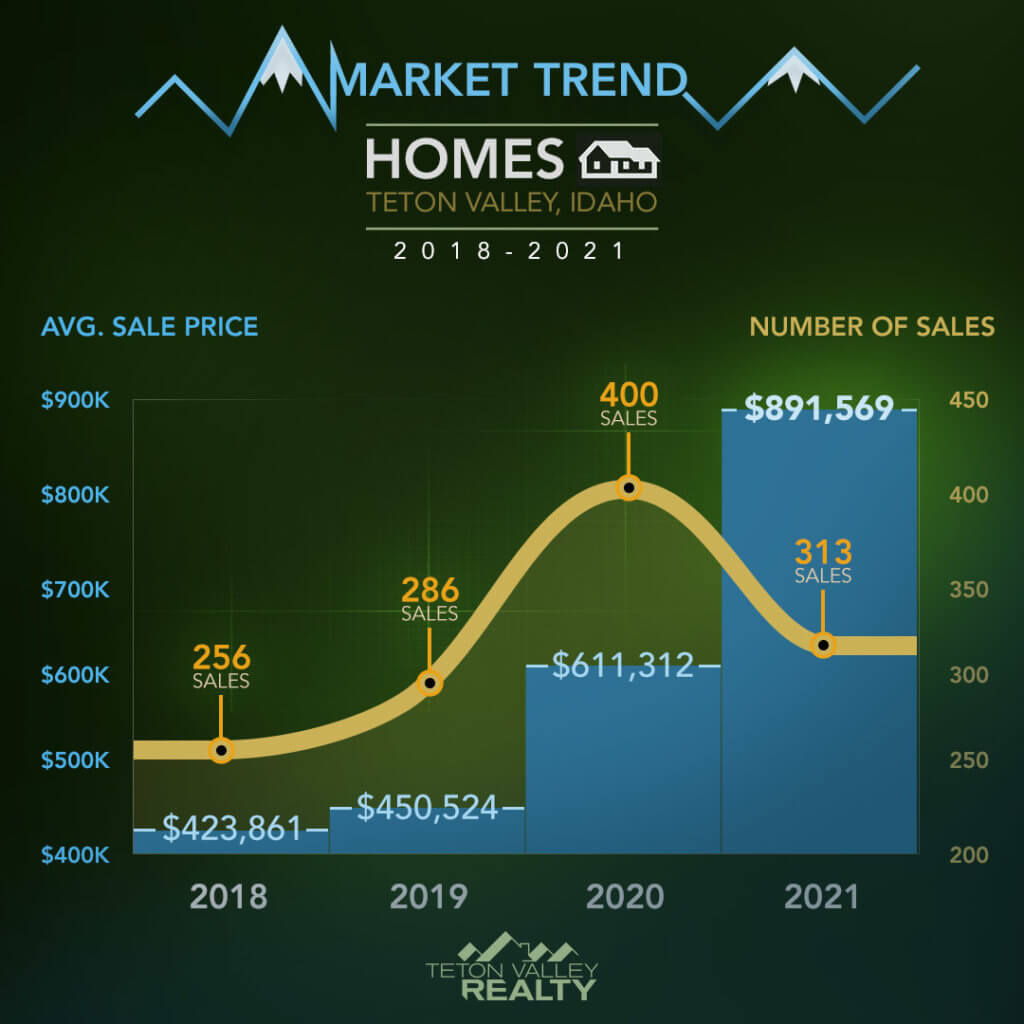

While the number of residential sales is down compared with 2020, the average sales price is a completely different story. Almost unbelievably, the average sales price in Teton Valley has more than doubled since year end of 2018, and has surged above $1m by the 3rd Q ’21.

Building Costs

Building costs have played a major role with respect to residential home prices, keeping inventory low and not giving spec home builders a confidence to meet the demand of new buyers to the area. It’s hard to quantify how much building costs have risen, but personal experience and interviewing with a few builders confirms my thoughts of somewhere in the range of 50 to 60% since 2020, somewhat consistent with the increase in the average sales price from 2020 to 2021.

2021 Year to Date

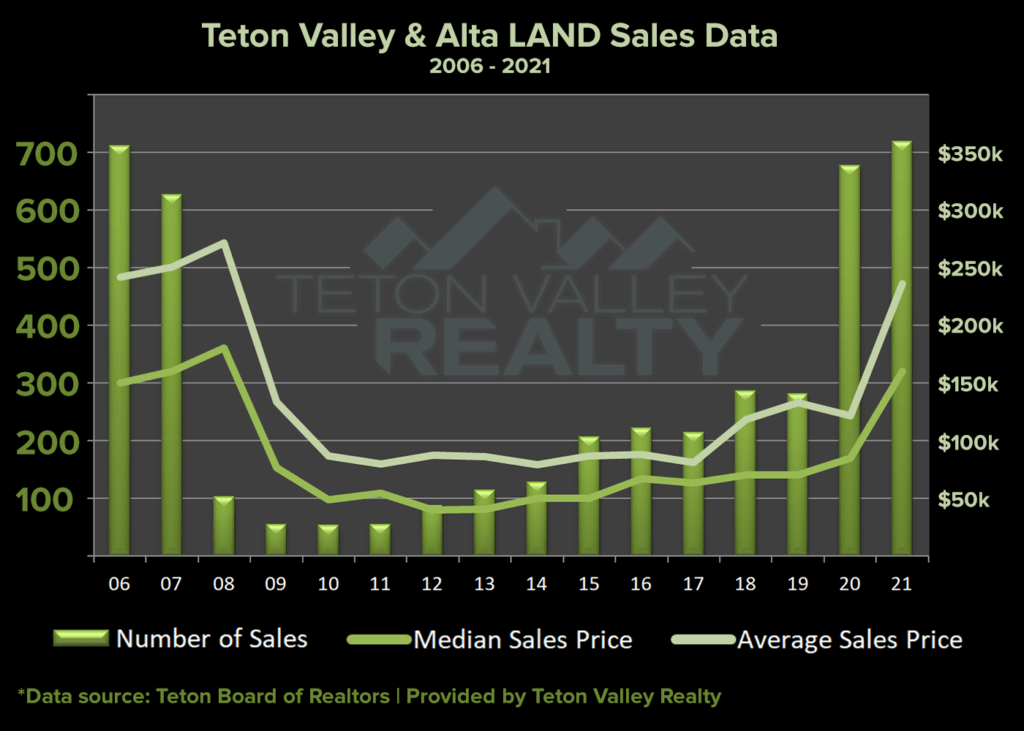

As with all market reports it’s important to look at both average sales prices as well as median sales prices that better indicate realistic numbers for middle of the road properties. A few key takeaways include the average sales price growing steadily quarter by quarter in 2021, but the median sales price reducing slightly in the fourth quarter, which is consistent with what we saw with 2021 land sales as well. Here are the numbers:

2021 Average Sales Price

Q1: 694,900

Q2: 966,655

Q3: 1,005,521

Q4: 1,093,040

2021 Median Sales Price

Q1: 558,429

Q2: 664,000

Q3: 724,950

Q4: 649,000

Predictions

This will probably sound a lot like all of those National news articles you’ve been reading, but most expect these unusual market increases as well as demand to subside back to normal rates sometime in 2022 due to supply chains catching up and interest rates increasing. With respect to our micro market, it’s hard to say when that will happen. Building costs remain high, lumber futures are again on the rise, and most builders are backlogged for the next 18 months or more. If we do see stabilization throughout the Nation, my suspicion is that it will take some time for Teton Valley to follow suit.