I’ve always got to start with my typical disclosures. I’m obviously not a builder, but I work closely with builders and stay in touch with customers that have projects in the works. I always tend to have a few projects going on myself, as well.

I wrote an article back in 2015 with information about my experience with the cost of construction. As you probably already know, things have changed quite a bit since then. In addition, a good portion of my 2015 project was sweat equity. I later constructed another small home in 2017, and I should have updated this article then as I relied more heavily on subcontractors, though I acted as the general contractor in both circumstances. I later again acted as my own contractor during an extensive remodel of my 1980s home, and I am currently closely involved in a project with a general contractor.

Getting back to the nuts and bolts, the cost of construction has gone up pretty dramatically. Obviously there are a few things at play here including material costs, supply shortages on both materials and labor, not to mention the cost of living which has changed pretty significantly since 2015. This definitely trickles down to the cost of labor as well. To have some fun, I looked at some of the material costs from my previous projects. I decided to use 7/16 OSB or sheeting as my “gold standard”. That may not be totally accurate across the board for all lumber and materials, but it’s a good indication as to what’s going on.

7/16 OSB, 2015-2022

2015: $9.22

2017: $14.71

2021: $23.99*

2022: $60 +/-

Materials

To be fair, that 2021 price is… not fair. If you were watching, you might remember there was a lumber bubble that popped in the Fall of 2021, and we all thought that may be a tipping point on material costs. That assessment was incorrect, as things jumped right back up to a high point, and continued that trajectory. The interesting point was how much that drop in lumber prices could impact a typical 2000 square foot home. The answer (in rough numbers) was about $15,000. Obviously some great savings in that scenario, but it’s probably not going to make or break the bank in the scheme of a large (or even a small) project. When we look at all material costs, you can see where it all starts to add up. Virtually everything is in high demand and is experiencing some sort of shortage. Appliances, tile, drywall, copper, plumbing materials, whatever. When you add it all up, it’s pretty significant.

Labor

As mentioned, the cost of living and therefore the cost of labor trickles down to costs; and can have a pretty significant impact on them. If a concrete company’s cost of labor goes up 20% because the cost of living is up 20% (realistically more) the contractor can’t just absorb that cost. Here again, concrete, framing, roofing, mechanical/electrical/plumbing… the list goes on. The biggest contributor to the issues described?

Supply and Demand

Supply of rental homes is extremely low. Supply of existing homes for sale is low. Materials, labor, contractors, everything is in low supply. Demand? You guessed it, through the roof – pun intended. While the lack of supply has a direct impact on the cost of materials and labor, there are indirect costs as well. If I can sell my used car for 10% more than I paid new, I am absolutely going to do that. In addition, I think there is likely some price gouging going on out there. Regardless, the bottom line is that people in small communities make their living when the economy is doing well. I’m not just speaking for myself when I talk (or think) about slow times.

What gives?

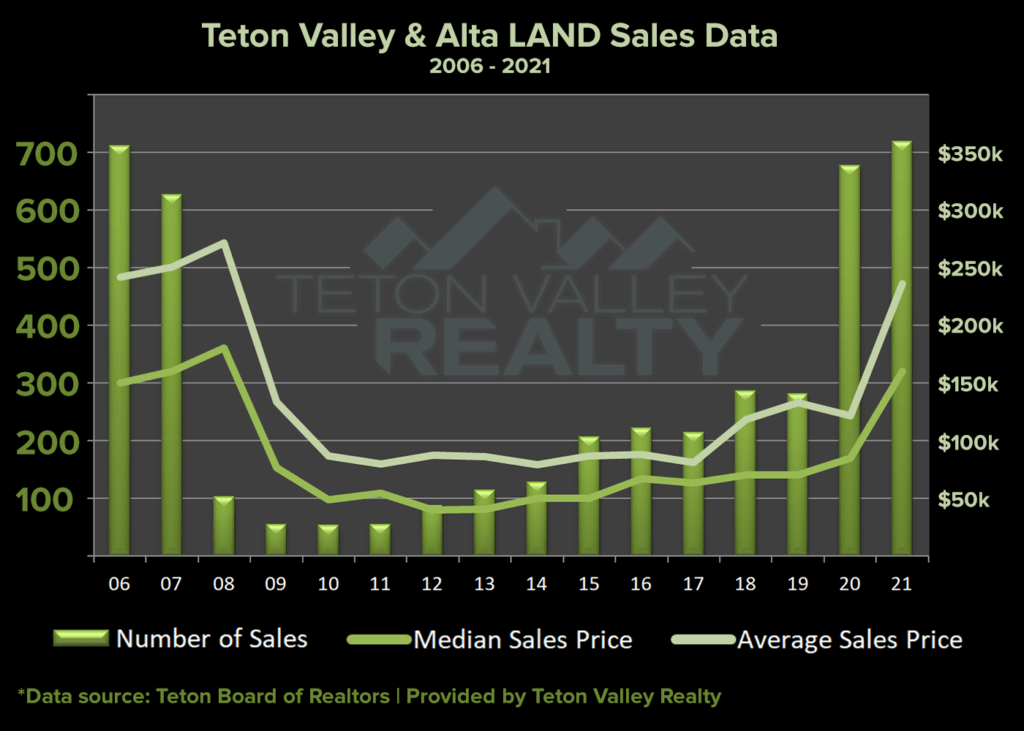

It’s interesting to read articles about economic cycles and what seems to be a universal opinion that times are different in terms of a potential real estate recession. Supply is still extremely low today. However, while leading up to the recession in the mid-2000s, supply was out of whack. Regardless, I’ll never make a steadfast economic prediction – and I’ll never promise that a recession won’t happen. That said, I do believe that rising interest rates will create some affordability issues (who am I kidding, there are already pretty significant affordability issues) that will tamp down the demand for construction which is already expensive. I also believe that notwithstanding prices rising so quickly, I do believe the pandemic created some shelter, keeping things in control because costs increased so significantly. With these changes in our economy, we can only hope to see some relief to balance the market. If this occurs, it will undoubtedly help stabilize some of these crazy construction prices.

Okay, I’m done blabbing about the stuff you probably already know.

So what’s it cost?

I didn’t reread my article, but I recall building my first project pretty affordably, keeping in mind that I did so much of that work myself. Costs obviously went up in 2017, and I do remember it getting more difficult to line up contractors – there was quite a bit more construction happening then. A few other considerations, some builders calculate a basic garage in their square footage cost estimate and I think you could accomplish that with the numbers below assuming modest construction, keeping in mind that Teton Valley’s modest construction tends to be a little on the “higher end” side of things including better heating systems, insulation, etc. Most of the contractors here use 5/8 drywall, 12 gauge wiring, and so on.

The Numbers

2015: $250/SqFt

2017: $310/SqFt

2022: $420/SqFt