8209 CUtthroat Lane, Victor ID 83455

3 bedroom 2 bath home located near downtown Victor in a popular development.

Why it’s a good deal:

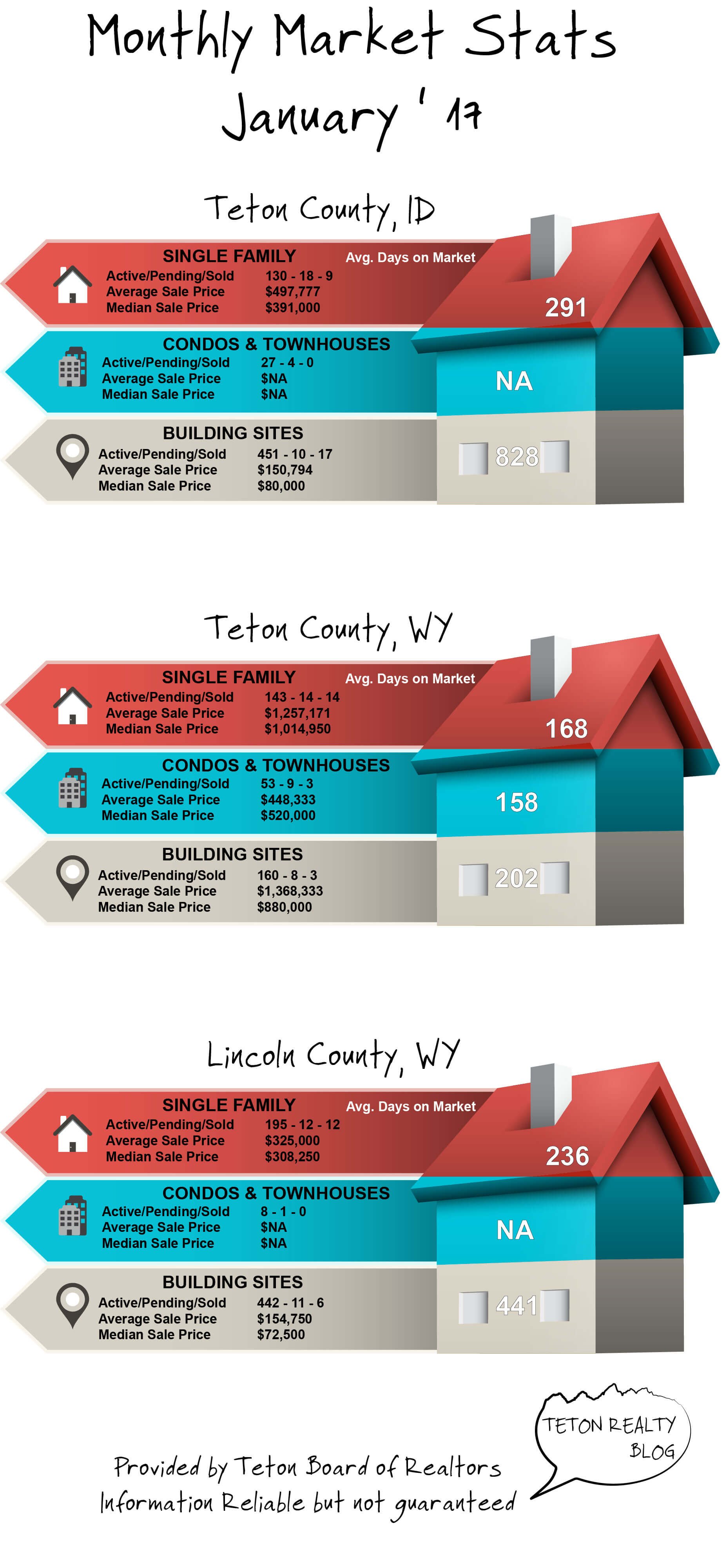

Well, it’s under 300k for starters. Moreover, Brookside Hollow is a quality development with homes sales far exceeding 300k.

How much?

$299,000.

How quick will it sell?

Pretty darn quick. This is a hot area, a hot segment and a reasonable price.

MLS info below. Log in to save this property.