Back in 2016, I wrote an article about what the election might mean for your real estate. After reviewing some interesting articles and data points, my conclusion was that real estate is much more impacted by market cycles than it is by election cycles. That being said, I did note some short-term volatility leading up to, and shortly after that election. This was true at that time, and here we are once again. In fact, the article was published at about this same time in 2016.

Having been through multiple election cycles over my years in real estate, I know this to be the case, but I was reminded of my 2016 article and talking points after receiving a market trends article written by Jordan Teicher for Zillow. As Brokers, we receive “market insider” information from the real estate giant. Despite my mixed feelings about Zillow, I still participate in advertising and follow their data points, trends and articles.

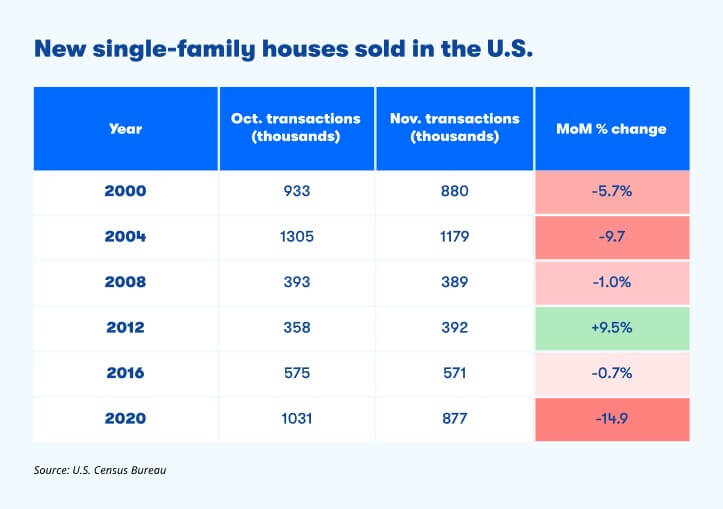

Jordan’s article dissected many common claims about reports of market volatility during election seasons and the claim that people are reluctant to move during these times. He was able to crunch some of the numbers using data from the US Census Bureau which confirmed a typical November slowdown following five of the last six presidential election years. The average month over month change during those six election cycles was -3.7% with only 2012 capturing a positive net change in the November following that election.

He went on to note that comparatively, in years without presidential elections, home sales increased an average of 0.6% between October and November. Over the past 20 years, he notes that transactions actually increased by an average of more than double all other years in December following presidential elections, “suggesting there may have been pent-up demand returning from those who were waiting to see how the election would play out.”

While none of this data may be surprising (it certainly is not to me) it does confirm what we think will continue to happen, a stabilizing market and likely an increase in sales as we move into the Winter peak season here in Teton Valley. As mentioned back in 2016, I believe the market will continue to be shaped by market supply and demand (and interest rates). 2020 threw us for a loop with diminishing supply and overwhelming demand, now with National trends pointing towards continued lack of supply with respect to housing starts. This broad dilemma and the theories behind it are further reinforced by micro factors in our own market including building costs and development challenges associated with growing pains and the continued challenges associated with a new Zoning and Land Development Code throughout Teton County.

Interested in a few associated articles? Don’t forget to check out the following links:

Driving Factors behind Interest Rates (2022)

Teton County Land Development Code

Sources:

– https://www.zillow.com/agent-resources/blog/presidential-election-housing-market/

– U.S. Census Bureau

Leave a Reply