It’s been awhile since we’ve given a full comprehensive market report of data over several years, so we felt it was high time, particularly with recent market volatility, stubborn interest rates, and an overall sense of a new market emerging from the craziness post COVID.

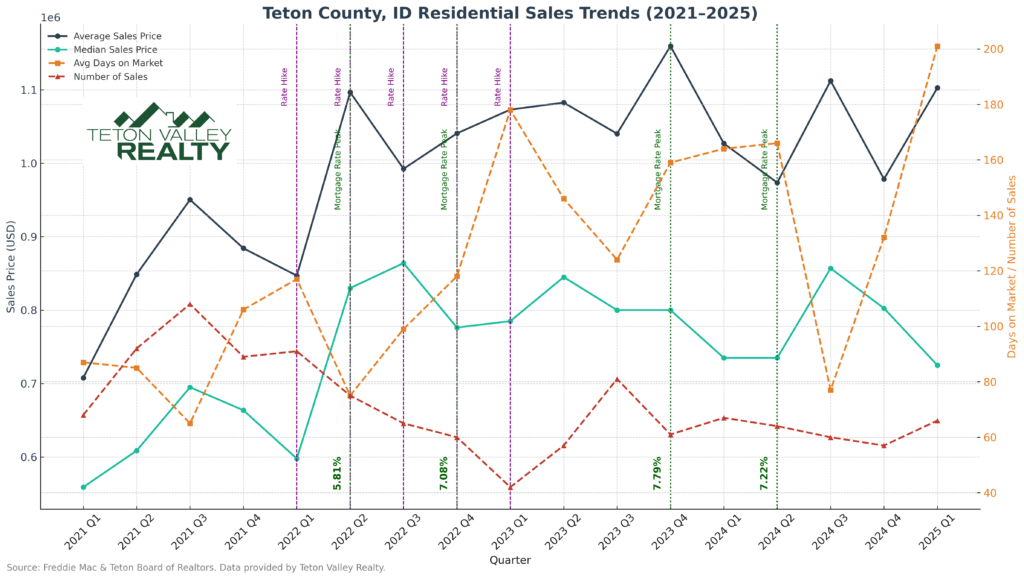

Using data since the first quarter of 2021 through the first quarter of 2025, we put together a graph with all of the data. While it might appear to be a jumble of information, let’s try to break it down.

Rate Hikes

The vast majority of the rate hikes occurred in 2022, so we indicated those with vertical lines. In the first quarter of 2022, we saw the first rate hike since 2018, followed by two rate hikes in Q2 2022, two rate hikes in Q3 and a another rate hike in Q4 of 2022. 2023 and onward witnessed slower hikes and pauses, but most of those were the first two quarters of 2023. The key metrics to watch here include the number of sales which decreased all through those noteworthy rate hikes, and the average days on market which increased mostly through the rate hikes, beginning with the second group of hikes – which makes sense to see this sector of the market lag behind and react to the Federal Reserve’s changes. Following those significant changes, you can see mostly just ups and downs. We’ll summarize that in greater detail below.

Average Sales Prices

The average sales price steadily increased, peaking in or around the 4th quarter of 2023, which seems about right for the market. If you ask most of our Teton Valley Realty Associates, they might agree that the top of the market was actually closer to the end of 2022, but again, it does not seem unusual to see a little bit of a delay here. While the average sales price ended on a high note in the first quarter of 2025, average numbers are easily skewed by large single transactions. A much easier picture to follow is the median sales price, which declined over the past few quarters back after a peak in Q3 2022 (more closely following the team’s sentiment). Similarly, about the time we saw those median sales prices decline, the average days on market again increased, ending at an all time high at the end of the first quarter in 2025.

Median Sales Prices

The median sales price saw its first significant increase, ironically after the rate hikes had begun. This seems to be the most delayed sector of the data from what we can interpret, but there was an area of confusion post COVID where prices (and people) really didn’t know where they were ultimately going to land, seeming to establish themselves with a high point in the third quarter of 2022, which is likely why many of our team Associates felt that was the peak of the market. There was an interesting surge during the third quarter of 2024, possibly due to rate decreases. This aligned with an inversion of the days on market, which sank nearly to a low point during that quarter in 2024.

Number of Sales

This data isn’t too conclusive, other than we saw the inventory bottom out at the end of the most significant rate hikes towards the end of 2023. We aren’t attributing this data to rate hikes, rather inventory diminishing as a result of increasing build costs and a continued strong Seller’s market. This again stabilized in 2023 and beyond, the point at which our team felt we were out of the “COVID era” and into a new market.

Summary, What’s in Store

Obviously, there’s no data to support what we might be in for, though broader market volatility has seemed to have put a short-term damper on sales. However, an interesting (small) bump in the first quarter of 2025 is noteworthy. Looking back through these first quarter milestones on the graph, however, you can see a surge at or around the first quarter of every year. This might be indicative of year end sales coming to a close, or a longer term trend. It’s not unusual for two peak seasons to dictate the greatest number of sales in our market, with the obvious ski season and busy Summer tourist seasons producing contracts, with sales to follow. Overall, we feel that there are a few things working for the real estate market’s continued growth, and a few things working against. Real estate “bulls” might argue that stock market investors might lose confidence and look to real estate for investment opportunities. Additionally, relief for interest rates is likely on the horizon, which could drive more sales. “Bears” would likely look at the overall market’s (stocks, bonds, real estate, etc.) sentiment and volatility trickling down to the real estate market after a long run of significant sales dollars and volume.

📚 Resources & References

📊 Real Estate Sales Data

Teton Valley Realty

Internal data on average and median sales prices, number of residential sales, and average days on market by quarter.

Teton Board of Realtors

MLS statistics for Teton County, Idaho.

💸 Federal Reserve Interest Rate Hikes

Federal Reserve – FOMC Meeting Statements & Historical Decisions

https://www.federalreserve.gov/monetarypolicy.htm

Tracked key interest rate increases during 2022 and early 2023, including:

March 2022: +0.25%

May 2022: +0.50%

June, July, Sept, Nov 2022: Multiple +0.75% hikes

🏦 30-Year Fixed Mortgage Rate Peaks

Freddie Mac – Primary Mortgage Market Survey (PMMS)

https://www.freddiemac.com/pmms

Used to identify weekly mortgage rate peaks. Notable peaks include:

June 23, 2022: 5.81%

Oct. 20 & Nov. 3, 2022: 7.08%

Oct. 19, 2023: 7.79% (highest in over 20 years)

May 2, 2024: 7.22%

📰 News Commentary & Mortgage Rate Analysis

Barron’s, CNBC, Mortgage News Daily

Provided additional commentary on market reactions to rate movements and borrowing impacts.